An Adamantine White Paper

Each year public companies hold their annual shareholder meetings in the spring, known as “proxy season,” and game-changing leaders watch to uncover what there is to learn. For oil and gas companies, 2021 was a proxy season like no other.

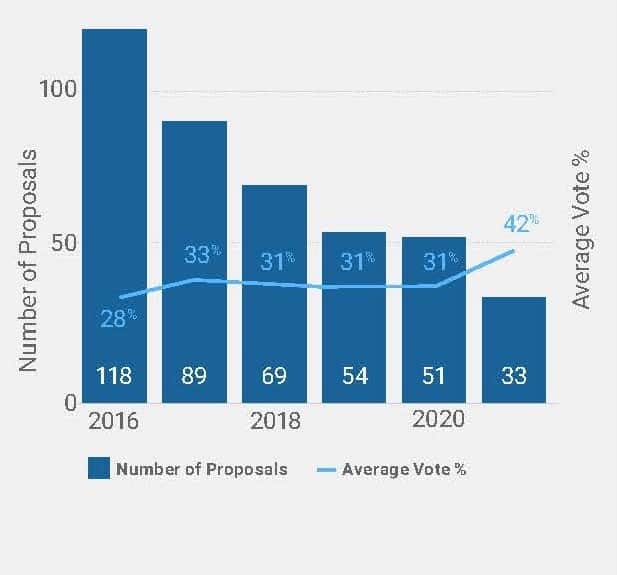

Average proposal voting percentages reached record highs as investors voiced increasing support on several key environmental, social, and governance (ESG) issues, including demonstrating robust commitments and progress on decarbonization, aligning stated ambitions with corporate advocacy, and demonstrating astute awareness and internalization of the transitional challenges ahead.

We at Adamantine have taken a careful look at the 2021 proxy season — and it tells us that oil and gas companies will need to accelerate and deepen their ESG strategy in several predictable ways.

This new Adamantine Energy white paper outlines the season’s key results, analyzes voting trends, and considers how investor expectations will shape the industry moving forward. Game-changing leaders will fold the season’s signals into their risk planning and strategy development; we offer a number of directions for that work at the end of this white paper.

Number of Proposals & Average Vote