What you’ll learn below:

- Key shareholder resolution trends from the 2023 proxy season – what passed, what didn’t, and what can we learn from each

- What the rise of anti-ESG proposals means for your sustainability strategy

- How to make climate progress while avoiding woke trends

Intro

Today I’m following up on Part 1 of Adamantine’s 2023 proxy season primer to assess how votes on the hot topics of shareholder resolutions hit oil and gas companies this year. Read on to find out how those results should impact your real sustainability strategy. First, let’s take an overview of what the season produced:

- Over 803 proposals were submitted to Russell 3000 companies (similar to 801 in the first half of 2022).

- Environmental proposals saw the sharpest drop in support, sliding from 35 percent in 2022 to 22 percent in 2023. At the same time, anti-ESG proposals more than doubled in the last three years, growing to 79 from 30 just three years ago.

- Despite the fanfare, none of the anti-ESG proposals received anywhere near a passing score (in fact, they averaged 3 percent support).

With increased proposals on both sides of the line, but unenthusiastic support for either, company executives may feel locked in a cultural tug of war. Instead of betting on one side, let’s focus on how oil and gas leaders are taking the lessons from proxy season to invest in an enduring sustainability strategy. In the words of English author Max Gunther, “If you’re losing tug of war with a tiger, give it the rope. You can always buy a new one.”

Both of these things are true:

- Opposing pro- and anti-ESG shareholder proposals saw increased volume, but cool support.

- Activist investing isn’t going away.

The situation

Here is how the trends we put on your radar in Part 1 played out.

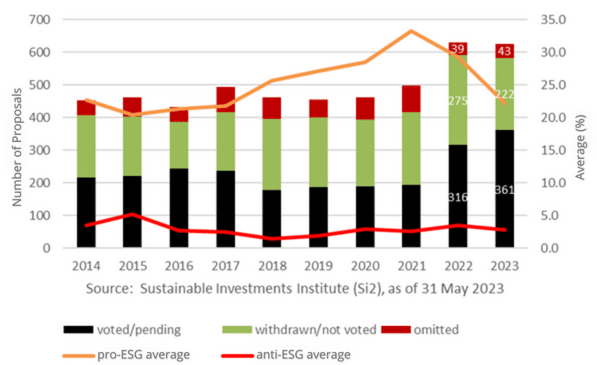

- ESG clarity. This year’s ESG proposals contained increased specificity and nuance, targeting areas such as Scope 3 emissions, transferred assets, and just transition. Support for all types of ESG proposals dropped. The proposals on environmental, social, and governance issues received 21.5 percent support, compared with 29.3 percent in 2022. Proposals for Scope 3 targets averaged more support, from 20 percent support at Shell to 30 percent at Total. Interestingly, outside of the industry, proposals for climate transition planning at big banks received the most support: Proposals at Bank of America, Wells Fargo, and Goldman Sachs requiring climate transition planning got around 30 percent support each, according to As You Sow, an advocacy group. At JPMorgan, a similar proposal received 35 percent support.

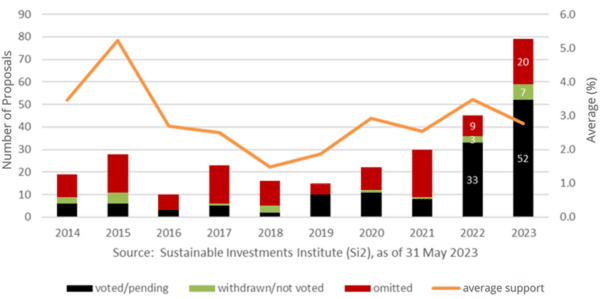

- Anti-ESG hubbub. When it came to anti-ESG, support for proposals earned an average of 2.8 percent across industries, declining from last year’s 3.5 percent (Figure 1). To put this into perspective, the average support rate for pro-ESG proposals reached around 28 percent (Figure 2). Proposals that garnered the most support in the anti-ESG realm focused on DEI programs (see ‘anti-social’ below), while only a little more than 10 percent focused on the environment and climate change. There emerged some interesting similarities between pro and anti-ESG activists, however. Analysis showed Strive, a notorious anti-ESG asset manager (and home of the DRLL ETF) and Engine No. 1, a pro-ESG investment firm known for replacing three Exxon board members in 2021, made the same voting decision on nine of the 44 resolutions they shared. These resolutions from Chevron, Exxon, and Meta focused on Scope 3 targets and just transitions.

- Board accountability. Board-level climate accountability played a minor role in this year’s proxy season. Proposals at Exxon and Chevron asking shareholders to vote against incumbent directors obtained less than 10 percent support. Proposals at the same two companies seeking to establish a board committee on decarbonization risk received less than 2 percent support. At Chevron, a proposal seeking an independent chair of the board got 20 percent support.

- Anti-social resolutions. Proposals around lobbying in line with climate goals, like these at Enbridge and Cenovus, saw a wide range of support from 18 percent to 99 percent, respectively. The climate-related just transition plan proposals we called out saw lackluster support—16 percent at Marathon and Exxon. Interestingly, a majority of the anti-ESG proposals we touched on above, around two thirds, focused on traditionally “social” topics like anti-discrimination policies and racial diversity.

Figure 1: Anti-ESG Proponent Resolutions in 2023

Figure 2: ESG-Related Proposals in 2023

It’s important to note that proposals with low to moderate support can’t and likely won’t be dismissed. A 2021 study by BlackRock shows that 75 percent of proposals that garnered at least 30 percent of votes resulted in companies taking action, while advisor Glass Lewis recently recommended that any resolution winning 20 percent or more of votes should lead to engagement between investors and company boards.

Seize the day

There will always be activist investors and—by definition—activist investors will continue to seek change. Companies can avoid the tug of war—ESG action, anti-ESG action—by investing in their real sustainability strategy, which allows them to parry both the culture wars and the corrections activist investors demand of companies. Specifically, oil and gas leaders should take to heart the following lessons from how their peers are handling these challenges:

- Think like an activist investor. Take an unbiased look at your company’s performance and the triple bottom line (people, profit, planet). What are your risks and opportunities? Where can you double down on performance and governance? Consider pressure-testing your corporate strategy against an outsider’s perspective. Doing so will only help fortify existing sustainability strategies.

- Don’t do nothing. “For” and “against” shareholder proposals do not cancel each other out. Instead, together, they represent twice the number of past activists agitating for change. Your strongest defense? A coherent real sustainability strategy tied to material opportunities and risks. This defense-cum-offense will be equally useful for the next activist frontier: legal action.

- Embrace the opportunity for dialogue. Many wise companies view activist interventions as an impetus for value creation. Because much activism represents the directional public pressure that energy companies face, this engagement with activists will give you first-hand insight on forthcoming lines of stakeholder expectations. Sometimes giving the tiger the rope is the best solution.

Directional pressure will continue to drive increased stakeholder accountability from oil and gas leaders. We will not see a permanent return to the days before climate and ESG action went mainstream. But that directional pressure gives you an unprecedented opportunity to build goodwill with shareholders, activists, and investors alike—through a coherent, pragmatic real sustainability strategy.

Adamantine can help you navigate the dual challenge of making climate progress without falling into woke trends. If you would like to recommend Both True to colleagues, they can subscribe here. Thank you to Savannah Bush for co-authoring this piece with me.

To either befriending a tiger or buying a new rope,

Tisha